- Slide inside family money restrictions of the condition

- Our home we need to get has actually good $224,five-hundred statewide cap

- Minimal credit history out of 640 otherwise 660 according to domestic kind of

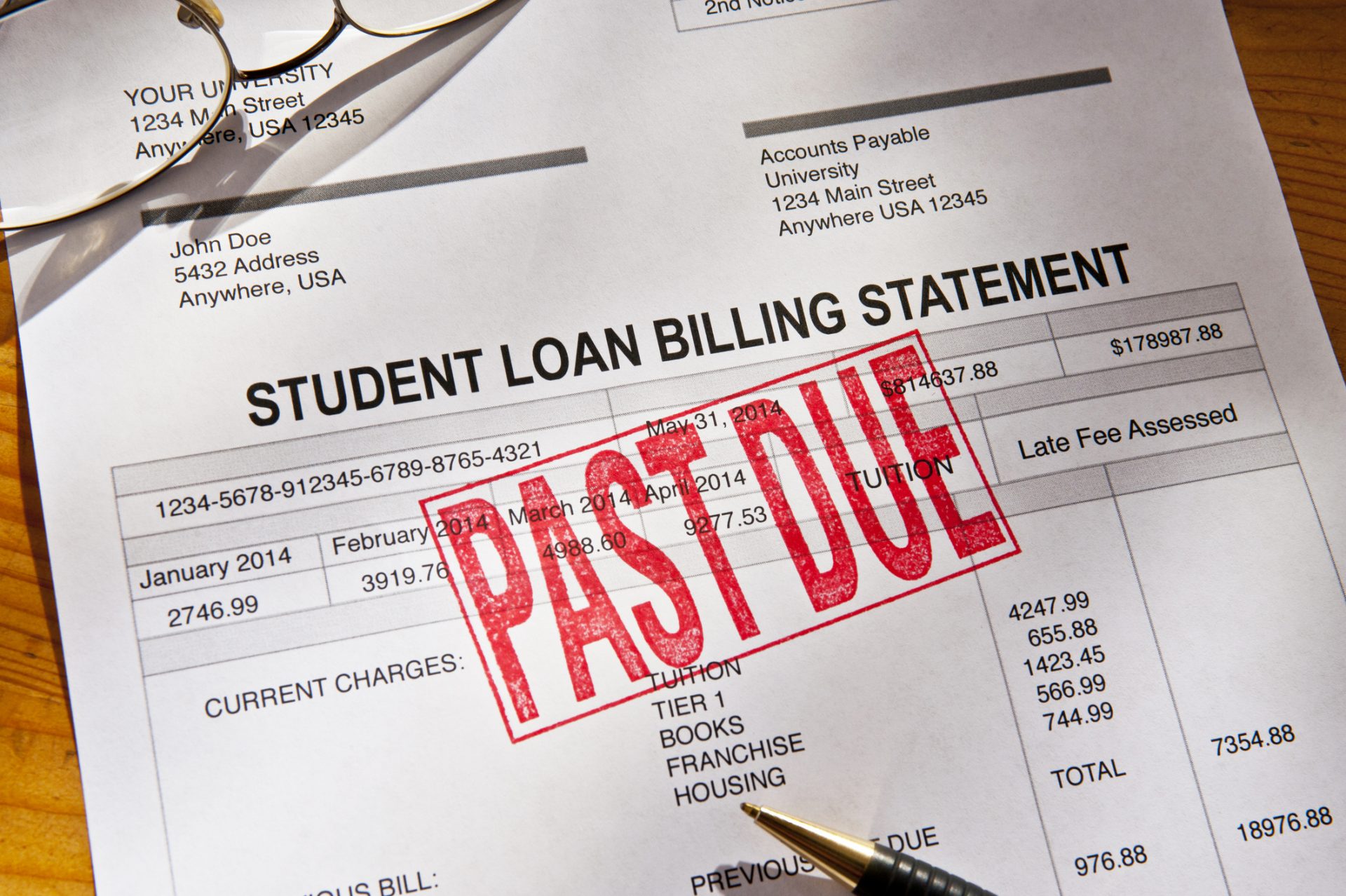

The latest Step forward Michigan system is even referred to as Hardest Struck Funds, and it will help homeowners get caught up on the mortgage payments, property taxation, otherwise miscellaneous charges. This method is federally financed through the state of Michigan. You can purchase around $31,000 from inside the assist with help you maintain possession in your home. So long as you stay in our home as your number 1 household, so it financing is actually forgivable for a price from 20% every year. Several eligibility criteria is actually:

- You’ve got facts you can keep your costs after you will be stuck upwards

- You had been a sufferer out of involuntary delinquency. Instance, away from medical expense, divorce proceedings, otherwise work losses

Flooding Insurance policies

Homeowner’s insurance rates generally speaking dont shelter flood. Every condition out-of Michigan is regarded as to possess a really low ton risk. Counties that have raised risk users are as follows.

- low risk: Department, Calhoun, Cass, Ingham, Lapeer, Livingston, Mecosta, Midland, Muskegon, Oceana, Ottawa, Saint Joseph, Wayne

- modest chance: Barry, Bay, Clinton, Eaton, Ionia, Isabella, Jackson, Shiawassee, Tuscola

- risky: Monroe, Saint Clair

Home buyers that have mortgage loans during the highest-risk section must get flooding insurance policies. Most flooding insurance coverage are sold from the Us government government from National Ton Insurance rates System. Under-valued flooding insurance coverage for the higher-exposure section play the role of good https://cashadvancecompass.com/payday-loans-sd/ subsidy so you can wealthy home owners.

The new NFIP does not costs nearly enough to safety this new questioned can cost you of the debts. The newest assessments aren’t adequate to build any boundary to pay for an amazing year, including exactly what happened having Hurricane Katrina from inside the 2005 or Hurricane Exotic inside 2012. As the homeowners you should never happen an entire cost of building within the a great ton region we end up getting much more properties indeed there than just in the event the residents sustained the full cost of brand new flood exposure, and that aggravate the latest government’s can cost you within the next crisis.

Homeowners who happen to live when you look at the lower chance areas & aren’t necessary to buy flooding insurance policies heavily cross-subsidize property owners who will be in places that flooding much more preferred.

Hail ruin is typical along the eastern side of the official. Damage regarding hail is typically protected by homeowners insurance policies.

Possessions Taxes

Michigan’s tax load enjoys , Michigan’s per capita income tax burden try underneath the national average. When you look at the 2014 new income tax burden inside the Michigan is actually $900, which metropolitan areas they 19% underneath the federal average. When you consider one another regional and you can county fees since a great percentage of individual money, Michigan is actually once again below the national mediocre out of 16%.

Other A residential property Legislation

Michigan keeps an adverse assets law, and this legislation setting anyone normally move into a home, uses a few basic steps, and get the fresh term compared to that family. The person need initiate this action of the moving into a vacant or quit possessions. They should individual so it possessions and you can a public and you can transparent method, and then make it obvious which they consume the dwelling. Brand new citizen need and then make improvements for the possessions and you will have the ability to show most of the improvements they are to make. Within the Michigan, this new tenant have to do so it for a period of fifteen years prior to capable allege the term towards assets and legally get it.

Within the 1993, Michigan taxpayers demanded a way to convenience its monetary burdens. They split the house or property into the a couple parts known as a homestead and you can low-homestead. New homestead property is a great homeowner’s no. 1 residence, and you may a non-homestead might possibly be a business or leasing possessions. Till the legislation, assets fees you are going to boost in accordance with the property’s condition equalized value, referring to 50% of one’s bucks property value the home. Offer A made use of a cap about precisely how much possessions fees you certainly will boost in one year. Following this proposal introduced, property taxation can not boost over 5% or perhaps the speed regarding inflation in just about any 12 months months. At exactly the same time, they additional $0.02 to the state conversion taxation as well.