Budgeting for your home loan

Whether you are preparing to get your earliest domestic or given a beneficial change for the forever domestic, finding out how mortgage recognition functions is important.

Once you sign up for home financing, loan providers imagine of a lot points just before your loan can be acknowledged. One such grounds ‘s the percentage of your month-to-month money you to are used for their financial.

Read on for additional info on debt ratio calculations, casing will cost you, and what part of your earnings can be used to your mortgage repayment.

Despite financial advice, the fresh part of your income that ought to go towards your financial payment ‘s the matter which you yourself can conveniently afford. Once you’ve calculated the amount you may be comfy expenses, you will need to make sure that your amounts try aligned together with your lender’s quantity.

Probably one of the most extremely important qualifying requirements you to definitely loan providers have fun with is actually also known as your debt-to-money proportion, otherwise DTI. Their DTI actions your own value by the isolating your housing costs because of the your terrible monthly earnings.

Their front-avoid ratio is employed to spell it out your own monthly homes fee split by your monthly earnings. So you can determine the side-end proportion, only divide your full homes expense by the disgusting monthly income.

The components loan providers imagine inside your mortgage repayment is more than just the principal and you may interest payment. There are other issue that define their overall homes bills.

- Principal: how much cash you borrowed from when you ordered your house, reduced in the longevity of your loan.

- Interest: the fee you only pay to use the bucks for your home financing, normally shown just like the an annual percentage rate (APR).

- Taxes: possessions fees, assessed from the state, are generally according to research by the assessed value of your house.

- Home insurance: homeowners insurance, called hazard insurance, becomes necessary by extremely lenders and you will covers your home and private possessions if there is damage otherwise theft.

- Financial insurance rates: individual mortgage insurance is required on the most of the conventional fund once you generate a down-payment below 20%. Home loan insurance policy is needed into the all the FHA finance.

- Connection charges: to keep common elements, cure trash and you may snowfall, which help enforce community statutes, of a lot neighborhoods and more than condos features a great homeowner’s association payment.

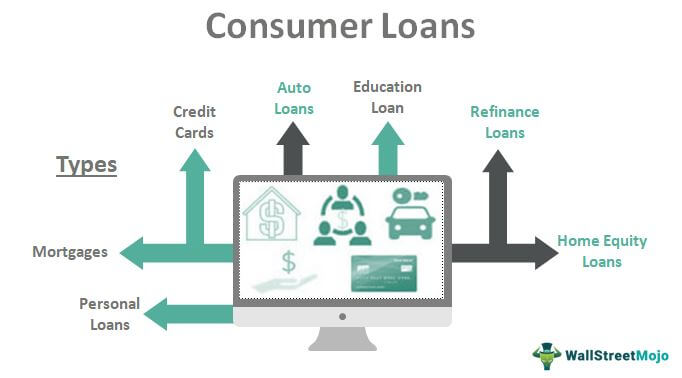

Your back-prevent proportion is the numbers it is possible to shell out with the housing, including repayments produced into handmade cards, auto loans, signature loans, alimony, etc. Lenders make use of straight back-avoid ratio alongside the top-avoid ratio to determine just how much you can afford so you’re able to borrow.

Prominent laws and regulations for percentage of money

For each and every bank has their own group of requirements when choosing just how far income can be utilized whenever delivering accepted for a mortgage. Usually, lenders realize obligations ratio guidelines as a general rule for deciding your qualifications.

The home loan borrower’s situation differs. Certain has actually advanced level borrowing from the bank, but possibly lower income. Someone else ount during payday loans online Arizona the savings, but their credit ratings commonly higher. Loan providers make use of these details whenever choosing home financing borrower’s qualifications.

Three activities are commonly utilized by loan providers so you can assess the fresh new percentage of income which should be used on your month-to-month homeloan payment.

This new code is utilized from the loan providers to choose simply how much household you can afford to acquire. Using this laws, the limitation domestic expenses you should never go beyond twenty eight % of your terrible month-to-month income. Thirty-six form your complete family expenditures, with their other month-to-month bills, are unable to surpass more than 36 % of one’s gross monthly money.

The newest signal

The brand new code is yet another code you to definitely issues on the terrible month-to-month income, yet what’s more, it requires your article-taxation money into account. That it design implies that the overall monthly bills, including your full construction costs, should not surpass thirty-five per cent of your pre-taxation, gross income, or forty five per cent of one’s post-tax income.