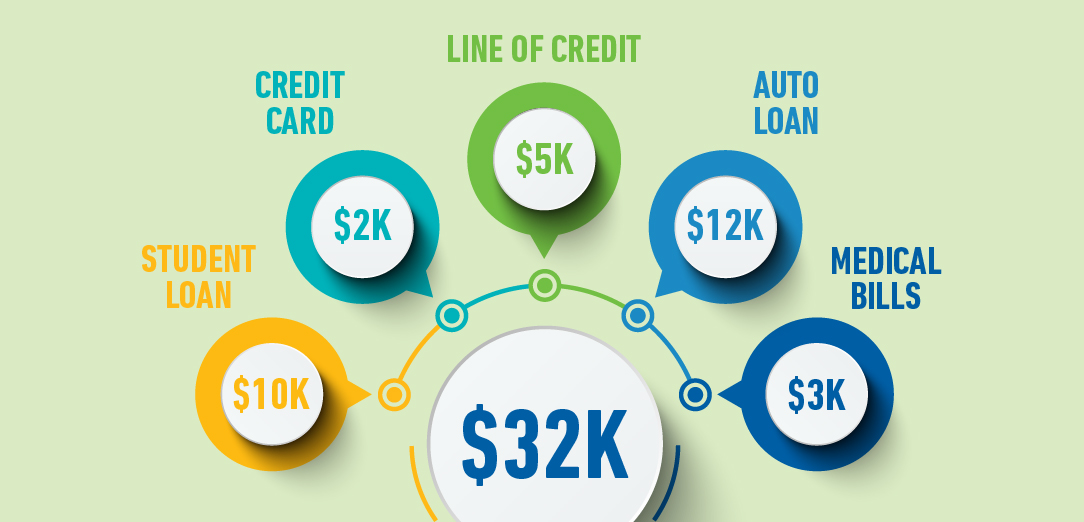

Cash-out refinancing can also be used to simply help combine your debt. When you yourself have several highest-interest rate credit cards, utilising the bucks out-of refinancing to spend those regarding will provide you fewer personal membership to consider. You’ll be able to still need to manage to pay back the fresh new personal debt, without a doubt, however now it will be together with the financial for the an effective unmarried easier payment.

Although not, a guaranteed mortgage entails that you could cure the assets-in such a case, your home-if not match monthly obligations.

The benefits of cash-aside re-finance

In the event that you carry out a finances-out refi? There are numerous benefits to envision, also down rates (for individuals who ordered your residence whenever costs was basically large), bucks having paying off high-appeal financing and you may handmade cards, and extra returning to paying highest-attention debt.

If you incorporate the money from your own refi toward paying down high-attention funds and you will credit cards, you might spend less as rate of interest on a finances-out refi is leaner than just one of the handmade cards. A profit-out refi may also make you more time to spend this new obligations back, that’ll lightens some financial tension.

Having fun with a finances-out refinance to repay those individuals higher-attention account might also alter your credit history, but if you fail to repay towards the re-finance, you may be prone to dropping your house plus credit could take a dip.

Because the mortgage focus was tax deductible, a funds-aside refi you will give you a larger income tax refund into the inclusion in order to assisting you lower your nonexempt income. And because cash-out refinancing enables you to borrow funds at the a low cost, utilizing it locate dollars getting home improvements, college tuition for your high school students, or any other major expense was a lot better than taking out fully a supplementary credit card otherwise financing.

The new downsides of cash-out refinance

It is very important think both the positives and negatives of money-away money. It is really not the best solution for everyone and sells specific risks, including:

Well-known chance is that you could reduce your residence or even still build regular payments on the new home loan. Including, there is also a chance that you may possibly in fact end up getting a high interest than just you currently have, since refinancing changes the regards to your own home loan.

Whether your interest is just about to improve from the refinancing, you’ll want to perform the math and you will consider if or not you to more cash is value they. In place of a lower interest than just you already have, this is usually far better maintain your most recent home loan. Also, you’ll want to carry out the mathematics towards the people settlement costs you may be required to spend after you refinance. Closing costs vary, but most try numerous otherwise thousands of dollars. If it is especially higher versus cash you are taking aside, a profit-away refi may not be beneficial.

While the a money-away refi takes 15 so you can three decades to repay, you do not want to make use of this one for selecting short-name otherwise luxury activities, such an alternate vehicles otherwise a vacation. You really need to very simply consider using they for the enhancing your much time-term financial predicament, not getting on your own toward deeper personal debt and you may risking your house.

How an earnings-aside refi performs

Just like your unique home loan, after you re-finance your residence, you can find clear procedures involved in the process. Some tips about what you really need to anticipate whenever qualifying and getting acknowledged to possess a finances-out refi.

step one. Render documents

Once you submit an application for a finances-aside re-finance, you ought to supply the same kind of paperwork required for their brand-new financial. This can include tax returns, W-2s, shell out stubs, lender comments, and you may a credit file. These records help to ensure your creditor of your borrowing from the bank worthiness.